RubinBrown Sports Betting Index: April 2025 Analysis

RubinBrown Sports Betting Index: April 2025 Analysis

April Sports Betting Index (SBI)

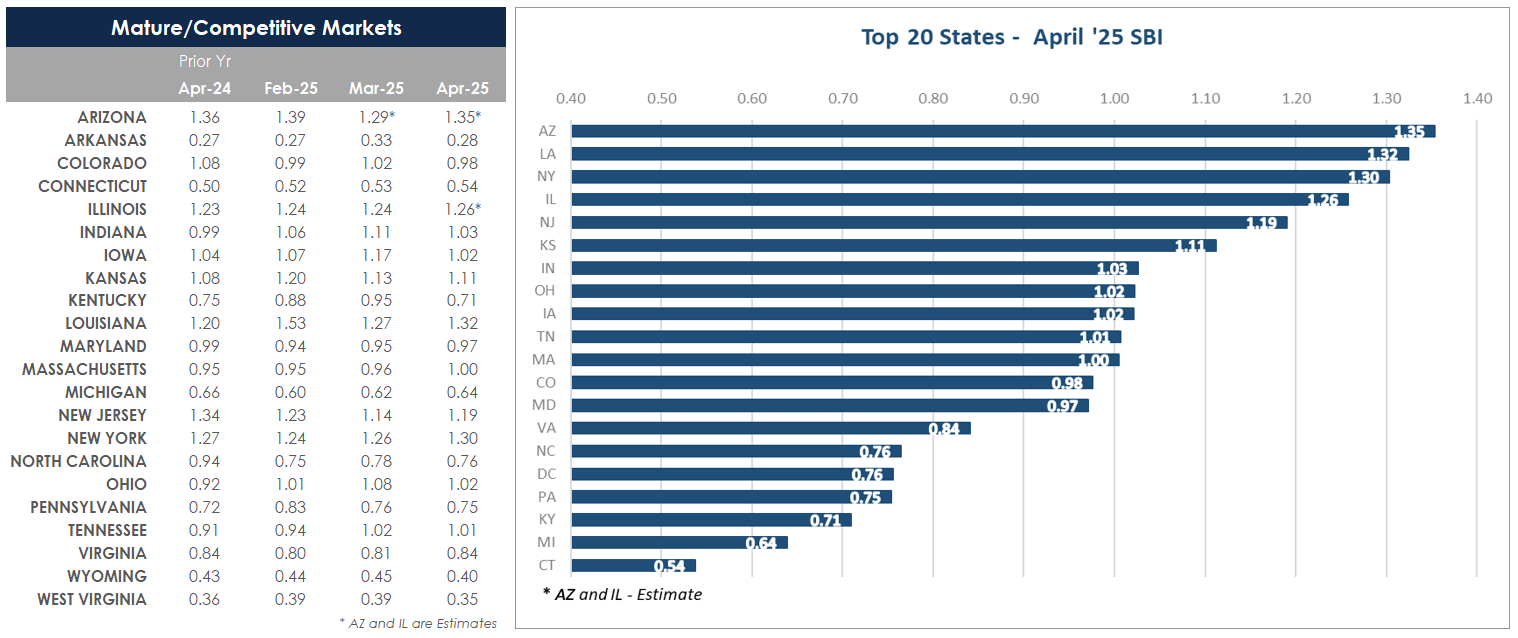

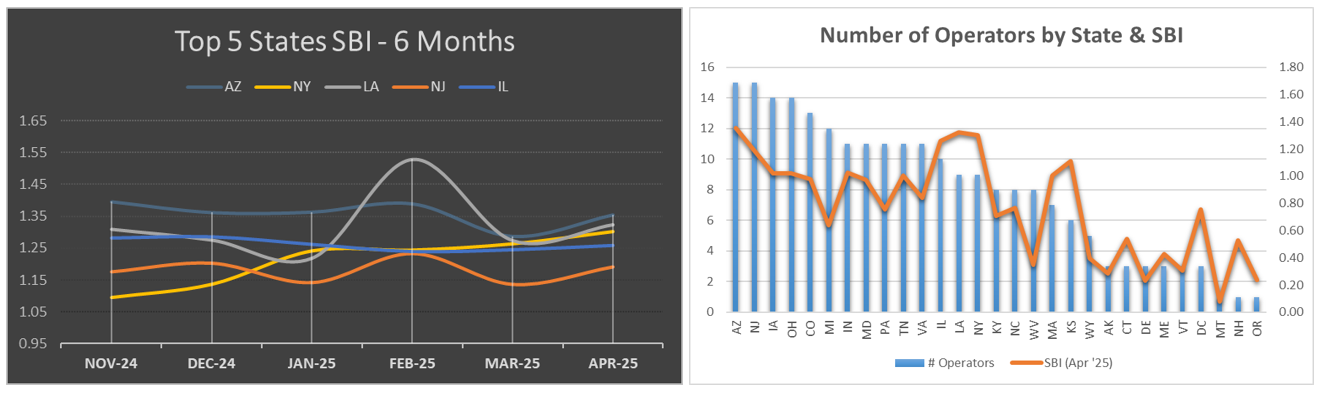

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

April saw a seasonal boost in U.S. sports betting driven by the mid-April start of the NBA playoffs. Basketball was the top category in several states, with Indiana reporting over 30% of its handle on the sport. Baseball closely trailed basketball in overall handle as its season kicked off. While engagement remains strong, structural cost pressures could reshape the economics of the industry. Illinois' new per-wager fee structure drew national scrutiny, with analysts warning it could lead to measures that would impact smaller bets from casual users. Major operators like FanDuel and DraftKings—who dominate the market and exceed volume thresholds, triggering higher fees—face pressure to prioritize profitability per user over volume, potentially changing how they approach user acquisition and retention.

Impact of Per-Wager Fees on Illinois Sports Betting Market (2025)

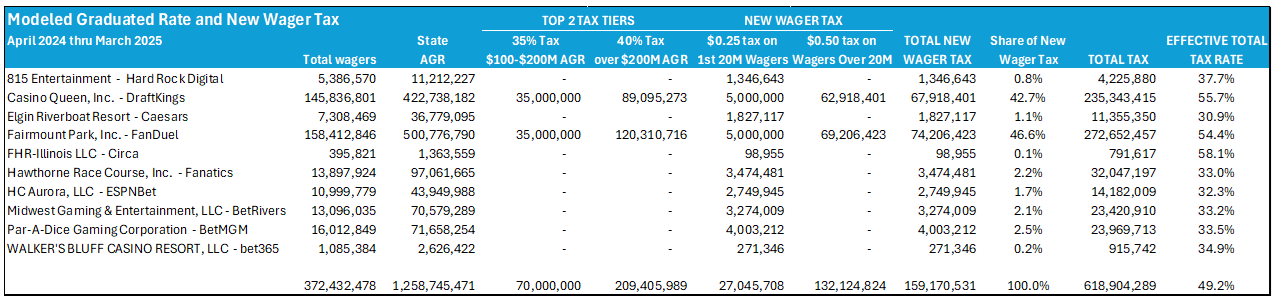

The newly introduced per-wager fee structure in Illinois—$0.25 per bet for the first 20 million wagers and $0.50 for each subsequent bet—represents a fundamental shift in how sportsbooks would be taxed. Unlike revenue-based taxes, this tax can have outsized impacts on smaller bets, which could lead to sportsbooks discouraging the activity that patrons have shown an increasing preference for.

At face value, a $0.25 to $0.50 fee per wager may seem modest. But in practice, it impacts smaller bets significantly. On a $10 wager, a $0.50 tax amounts to a 5% fee—wiping out the sportsbook’s expected profit margin. Traditionally, sportsbooks expect between 4-7% hold on straight bets, as opposed to the increasingly popular parlay bet, which involves multiple outcomes. In essence, if a bettor wagers $10 on a straight bet, the $0.50 tax on that wager will theoretically take all expected margin from the sportsbook.

To preserve profitability, operators have already begun to adjust their pricing models. The largest operators, FanDuel and DraftKings, have decided to pass these fees along to their customers in the form of a $0.50 fee on ALL bets, not just those made after the 20 million wager hurdle. Both DraftKings and FanDuel's parent company, Flutter, have also said that they will remove the 50-cent charge if Illinois lawmakers reverse course on this latest tax change. While the fee is technically levied on operators, its economic burden will be passed through to consumers.

Similar to the July 1, 2024, graduated tax rate adjustment, this burden weighs the heaviest on the top two operators, FanDuel and DraftKings. According to Illinois Gaming Board reports, they are the only Illinois providers who have exceeded the 20M bet mark, after which wagers are subject to a $0.50/bet fee. We modeled the trailing twelve months (TTM) as if both the graduated rates and per-bet fees were in place for the entirety and found that FD and DK were the only operators to pay the top 2 graduated tax tiers and will account for nearly 90% of the per-bet wager fees:

When considering there are other taxes still to be paid (state gaming tax, county tax for Cook County wagers, and a federal excise tax), operators have little incentive to accept small bets. In fact, for a bet placed within Cook County through either of the largest operators when subject to the top GGR and bet number tax tiers, a $50 straight wager subject to a $0.50 fee yields an effective tax rate of approximately 67%. It is difficult to see net profits at such tax rates; hence the expectations they may adjust the odds unfavorably for patrons. Some operators could instead switch to a parlay-only operation. Even hitting their touted goal of seeing a sustained 15-20% hold, the largest operators would still need minimum bets to be raised to uncomfortable levels for many patrons. A $10 parlay bet with a 15% expected hold placed in Cook County would see a 76% effective tax rate. It’s anyone’s guess what new minimum bet levels could be, but the math suggests something like $75 minimum bets for straight wagers and $20 minimum bets for parlays are quite possible to reduce the effective tax rates on wagers to 60% or less, at least for the two largest operators.

Impact on Responsible Gaming

All options will be considered carefully, but it must be pointed out that they could lead to customers engaging in less responsible gaming practices. If a customer is charged a fee to place a bet, as both FanDuel and DraftKings have proposed, they may consider raising their wager to “cover the cost” of the fee. Some bettors who could comfortably bet $10 per wager may bet multiples of this bet size when faced with higher minimum bets. Unfavorable pricing could lead to patrons’ bets paying out at significantly lower odds, which could lead to bettors making larger wagers.

Maybe the worst outcome would be customers leaving the regulated marketplace altogether, eschewing their options for neighborhood bookies or the offshore market, where responsible gaming practices are not the priority they are in the regulated market. Moving to the unregulated market due to pricing changes and/or passed-through tax impacts could impact efforts to protect the integrity of the games, which we believe most patrons do care about, as well as the taxes collected from gaming, which generally support good causes in the community.

Potential Unintended Impacts

Ultimately, Illinois’ effort to increase tax revenue in the short term could lead to reduced accessibility and engagement for patrons, which brings long-term risks for the market. The pursuit of short-term fiscal gains could lead to fewer residents participating in the regulated market, lower taxes than expected being collected by the state, and even potentially high-profile departures from the market by those suffering an outsized burden from the tax changes. What may be left could be a far less diverse and competitive market for Illinois residents and a far less attractive market for consumers, with the potential for responsible gaming and integrity issues developing over time.

Published: 06/23/2025

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only, (ii) is based on the accuracy and completeness of the facts you have provided us, and (iii) may not be relied upon to avoid penalties.